Table of Contents

- lexi adlı kullanıcının New house ! panosundaki Pin, 2024

- Tips For Selling Your House In 2024 - The Ultimate Home Selling Guide ...

- Resale 6 Bedroom 167 Sq.Ft. Independent House in Sheela Nagar Vizag ...

- Fifa World Cup 2026 Los Angeles - Lexy Sheela

- Lexus Suv 2024 Gx 550 - Zora Annabel

- 2024 Lexus Gx 460 Hybrid - Liuka Shannon

- 2026 Chevrolet Silverado Concept Revs Up The Imagination | GM-Trucks.com

- How to Buy a House in 2024 (STEP BY STEP) - YouTube

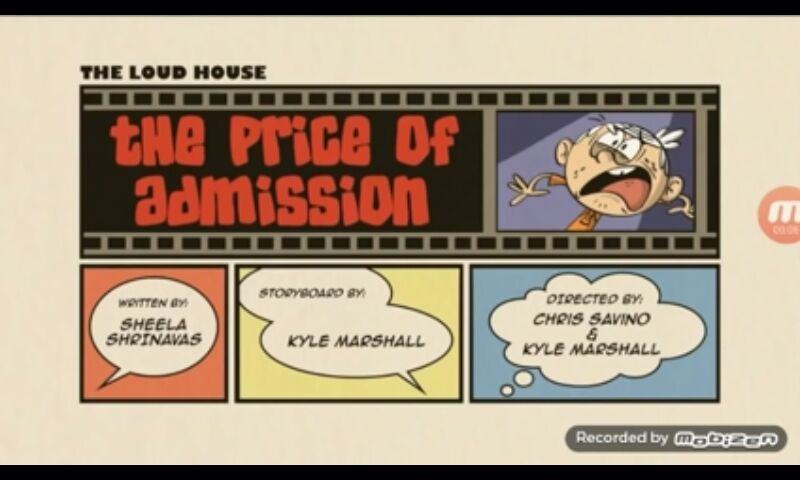

- Sheela Shrinivas | Wiki | The Loud House Español Amino

- When Is The Next Comic Con 2024 Uk - Darice Belicia

Market Trends: A Comparative Analysis

Experts predict that the average housing price in 2025 will increase by 3-4%, while 2026 may see a more modest growth of 2-3%. This subtle difference in market trends can significantly impact homebuyers, particularly those seeking to maximize their investment returns.

Interest Rates: A Key Factor in Homebuying Timing

A study by the National Association of Realtors found that a 1% decrease in interest rates can increase homebuying power by up to 10%. Conversely, a 1% increase in interest rates can reduce homebuying power by up to 10%. This highlights the importance of considering interest rates when deciding on the optimal homebuying timing.

Economic Factors: Employment, Inflation, and GDP

The overall state of the economy also influences the homebuying market. A strong economy, characterized by low unemployment, moderate inflation, and steady GDP growth, can boost consumer confidence and increase demand for housing. Experts anticipate that 2025 will see a robust economy, with the potential for increased job growth and lower unemployment rates.In contrast, 2026 may experience a slight slowdown in economic growth, potentially affecting consumer spending and housing demand. The Bureau of Labor Statistics predicts that the unemployment rate will decrease to 3.5% in 2025, while 2026 may see a slight increase to 3.7%.

Expert Insights: Weighing the Pros and Cons

When considering the timing of homebuying, experts recommend weighing the pros and cons of each year. For 2025, the advantages include: Moderate housing price growth Relatively stable interest rates Strong economic growth However, the disadvantages include: Limited housing supply Potential for increased competition among buyers For 2026, the advantages include: Potential for decreased competition among buyers Possibly lower housing prices However, the disadvantages include: Slightly higher interest rates Slower economic growthUltimately, the decision on homebuying timing depends on individual circumstances and priorities. Experts advise potential homebuyers to consult with financial advisors, assess their personal financial situation, and carefully evaluate the market trends before making a decision.

In conclusion, the timing of homebuying in 2025 versus 2026 depends on various market trends, interest rates, and economic factors. By understanding these factors and weighing the pros and cons, potential homebuyers can make informed decisions that align with their goals and priorities. Whether you're a first-time buyer or an experienced investor, it's essential to stay informed and adapt to the ever-changing real estate landscape.