Table of Contents

- Corporate Tax Return Deadline 2025 - Alis Lucina

- 2025 Tax Filing Deadline California - Taylor Casey

- 2025 Tax Deadline Calendar - Aya dekooij

- Tax Extension Deadline 2025 - Quade Vacumm

- Tax Deadline 2025 Extension Date Time - David Bower

- 2025 Tax Filing Deadline California - Taylor Casey

- Tax Extension Deadline 2025 - Quade Vacumm

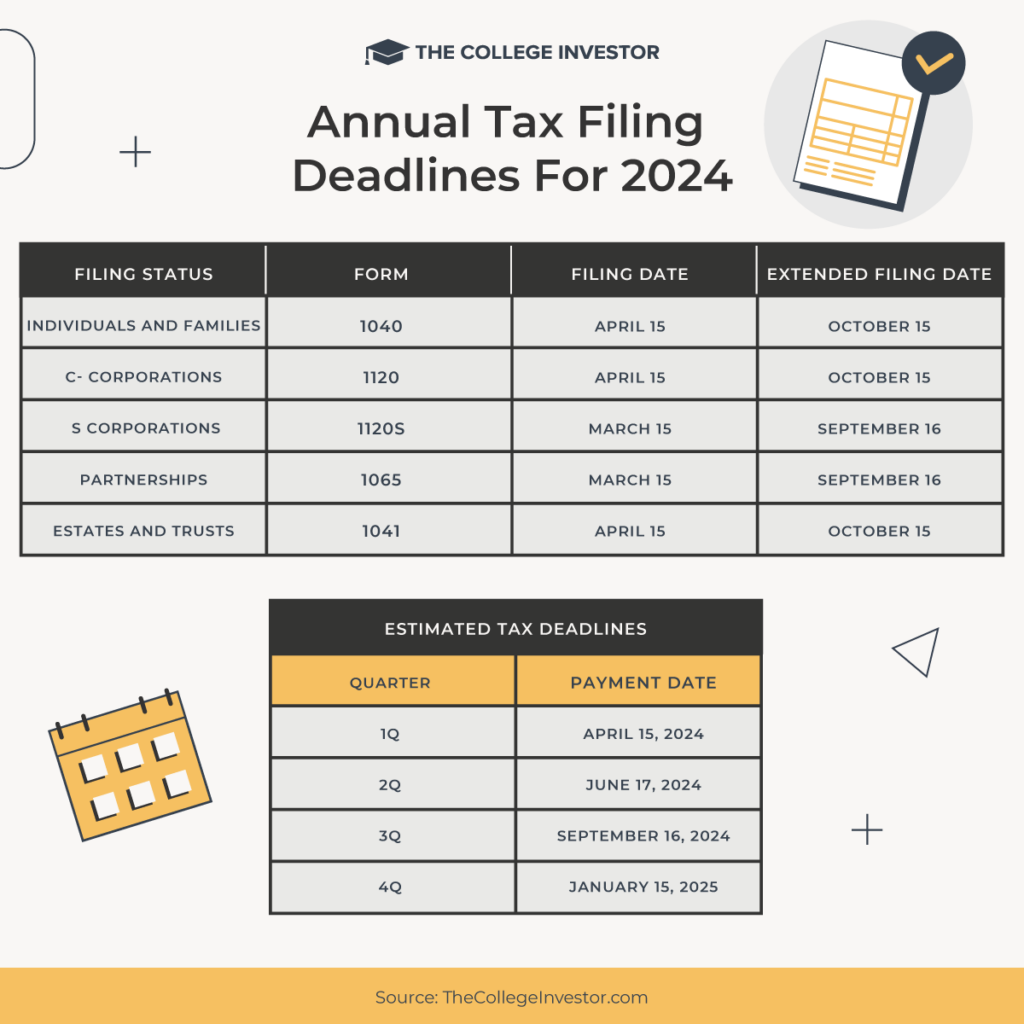

- Business Tax Deadlines 2025: Corporations and LLCs

- Tax Payment Deadline 2025 - Ardene Carlynn

- Tax Report 2025 Deadline - Kacy Georgine

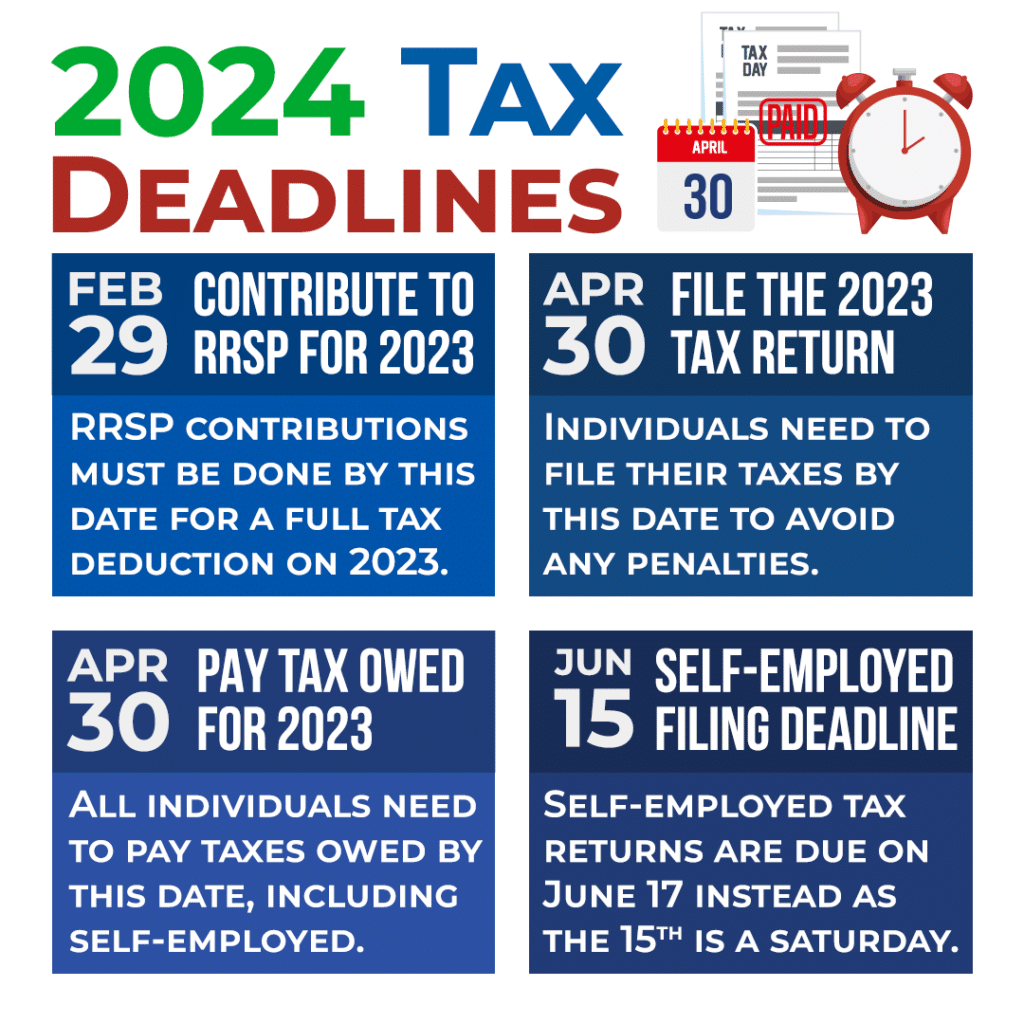

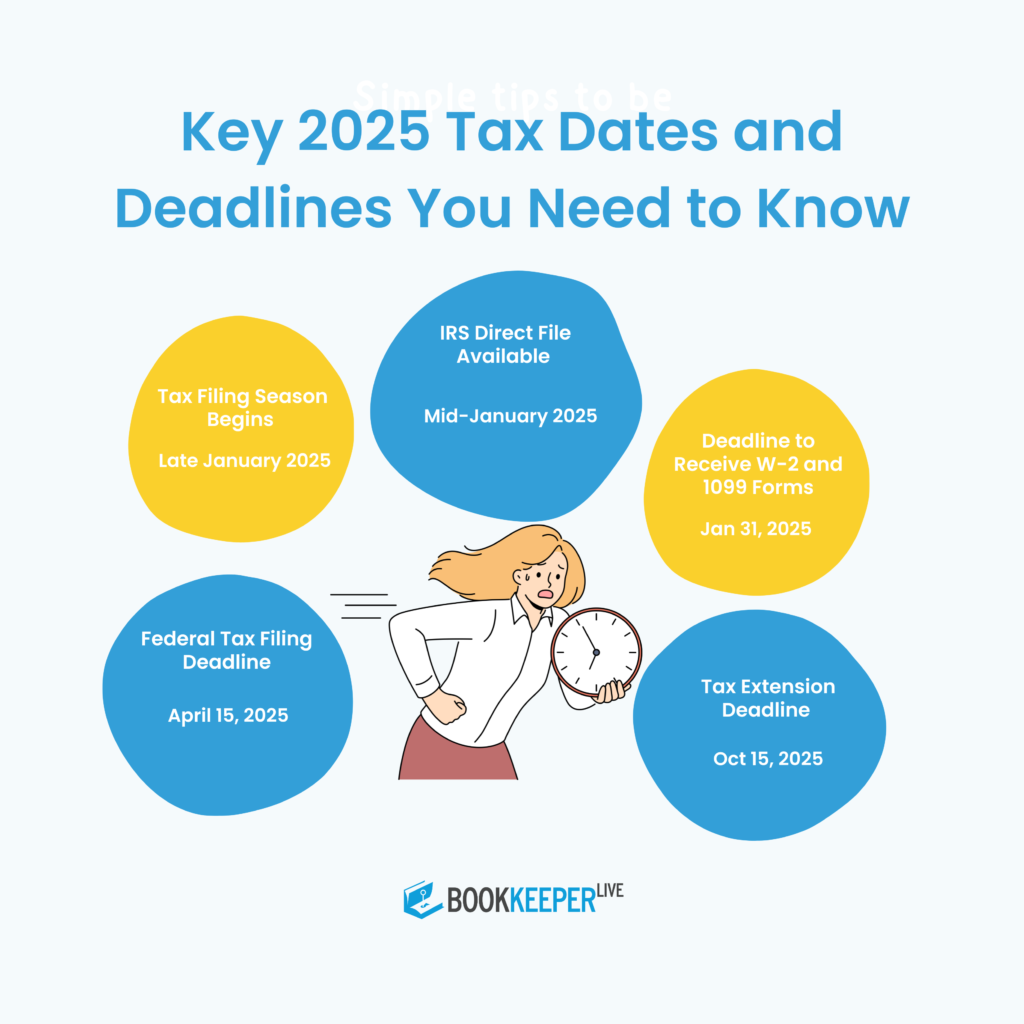

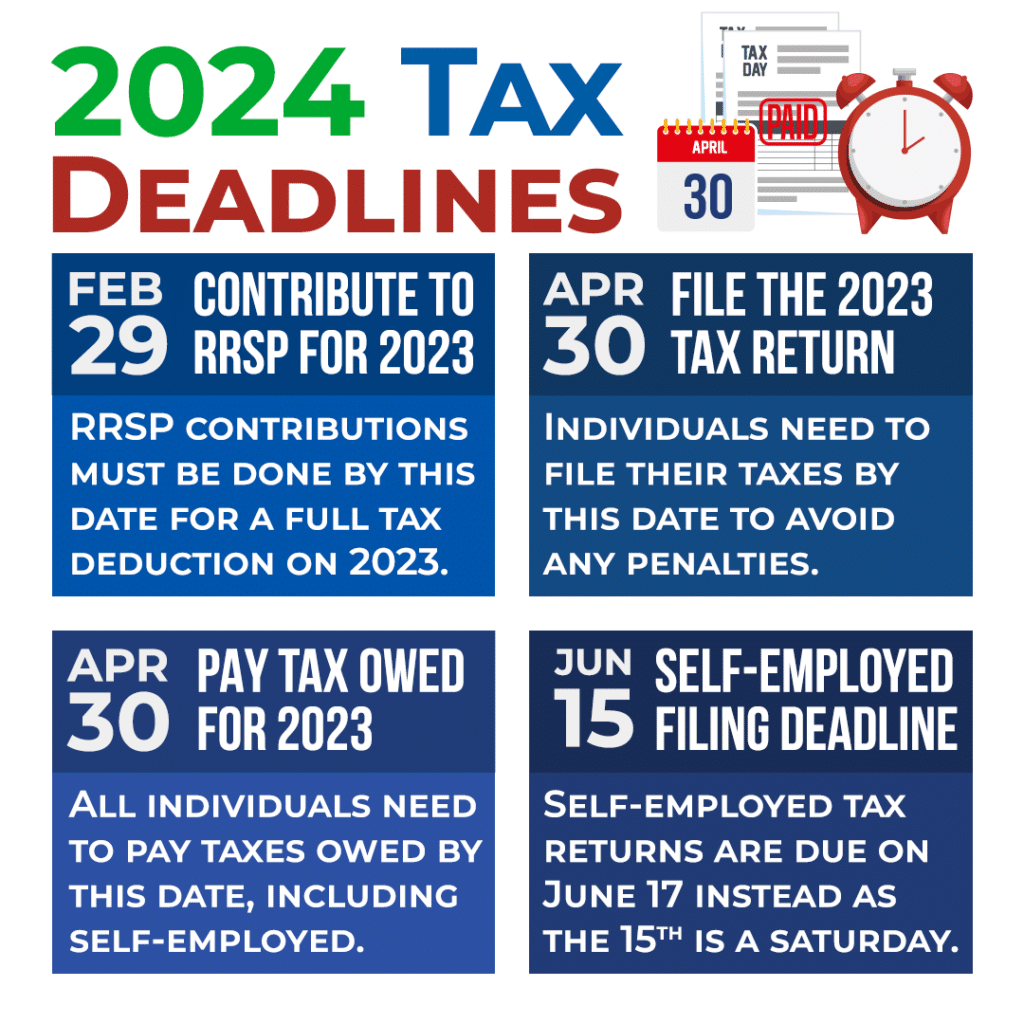

Individual Tax Dates

Business Tax Dates

Other Important Tax Dates

January 1, 2025: New tax laws and regulations take effect April 1, 2025: First quarter estimated tax payment due for individuals and businesses July 31, 2025: Second quarter payroll tax reports (Form 941) due October 31, 2025: Third quarter payroll tax reports (Form 941) due

What to Expect in 2025

The 2025 tax season is expected to bring several changes and updates, including: Increased standard deductions and tax brackets New tax credits and deductions for individuals and businesses Enhanced security measures to prevent tax-related identity theft Improved online services and e-filing options for taxpayers Staying on top of important tax dates is crucial to ensure compliance and avoid penalties. By marking your calendars with the essential 2025 tax dates outlined above, you'll be well-prepared for the upcoming tax season. Remember to consult with a tax professional or financial advisor to ensure you're taking advantage of all the tax credits and deductions available to you. Stay informed, stay compliant, and make the most of the 2025 tax season.Source: Bloomberg Tax

Disclaimer: This article is for general information purposes only and should not be considered as tax advice. Please consult with a tax professional or financial advisor for specific guidance on your individual or business tax situation.