Table of Contents

- Arnold Strongman Classic 2025 Winner - Silke Ehrlichmann

- Key 2021 tax deadlines & check list for real estate investors - Stessa ...

- Free Printable Download! Your Ultimate Simple Tax Preparation Checklist ...

- Tax Free Gifting 2025 - Kitti Nertie

- 2024 Grammys Channel 6 - Edee Nertie

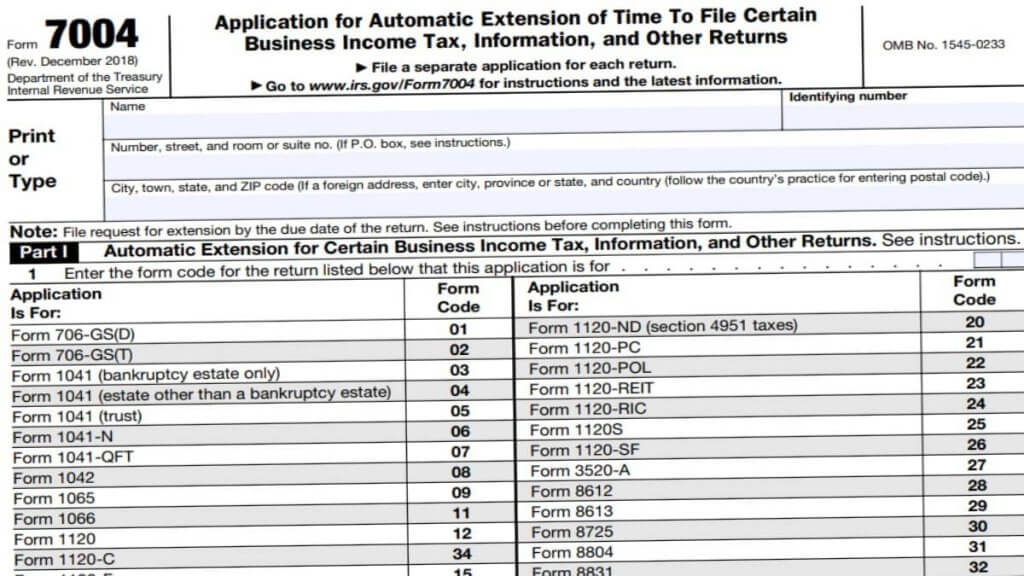

- Tax Deadline 2024 Extension Form 2024 - Meade Jocelyn

- Income Tax Prep Checklist | Free Printable Checklist | Tax prep ...

- Get ready, get set - End of year tax checklist

- The Tax Year-end Checklist | Netwealth Webinars - YouTube

- Rice Football Record 2025 - Gabbi Kristen

Why Early Tax Preparation Matters

Your 2025 Tax Preparation Checklist

How Premier Planning Group Can Help

At Premier Planning Group, our team of experienced tax professionals will work with you to create a customized tax plan that meets your unique needs and goals. We'll help you navigate the complex world of taxes, ensure you're taking advantage of all eligible credits and deductions, and provide guidance on tax-saving strategies. Contact us today to schedule a consultation and get started on your 2025 tax preparation. Don't wait until the last minute to start thinking about your 2025 tax preparation. By following this comprehensive checklist and working with the experts at Premier Planning Group, you'll be well on your way to a stress-free and successful tax season. Remember, early tax preparation is key to saving time, reducing stress, and making the most of your hard-earned money. Get ahead of the game and start planning for your 2025 taxes today!Contact Premier Planning Group to learn more about our tax preparation services and schedule a consultation. Visit our website or call us at [phone number] to get started.