Table of Contents

- Jamie Eaton on LinkedIn: Have you maxed out your 401(k) match and your ...

- 2025 Roth Ira Contribution Limits 401k Roth - Roy M Becker

- The IRS has announced 3 key changes to 401(k)s for 2025 — here's how to ...

- Irs 401k Limits 2025 Married Filing Jointly - Betsey Vinnie

- The Maximum 401(k) Contribution Limit For 2020 Goes Up By 0

- The Maximum 401(k) Contribution Limit For 2020 Goes Up By 0

- Roth 401(k) Contribution Limits for 2021 | Kiplinger

- 401(k) Contribution Limits In 2024 And 2025 | Bankrate

- Maxing Out 401(k) & Roth IRA Plans | Limits, Benefits & What Is Next

- Notable 401(k) and IRA plan changes for 2025 | Accounting Today

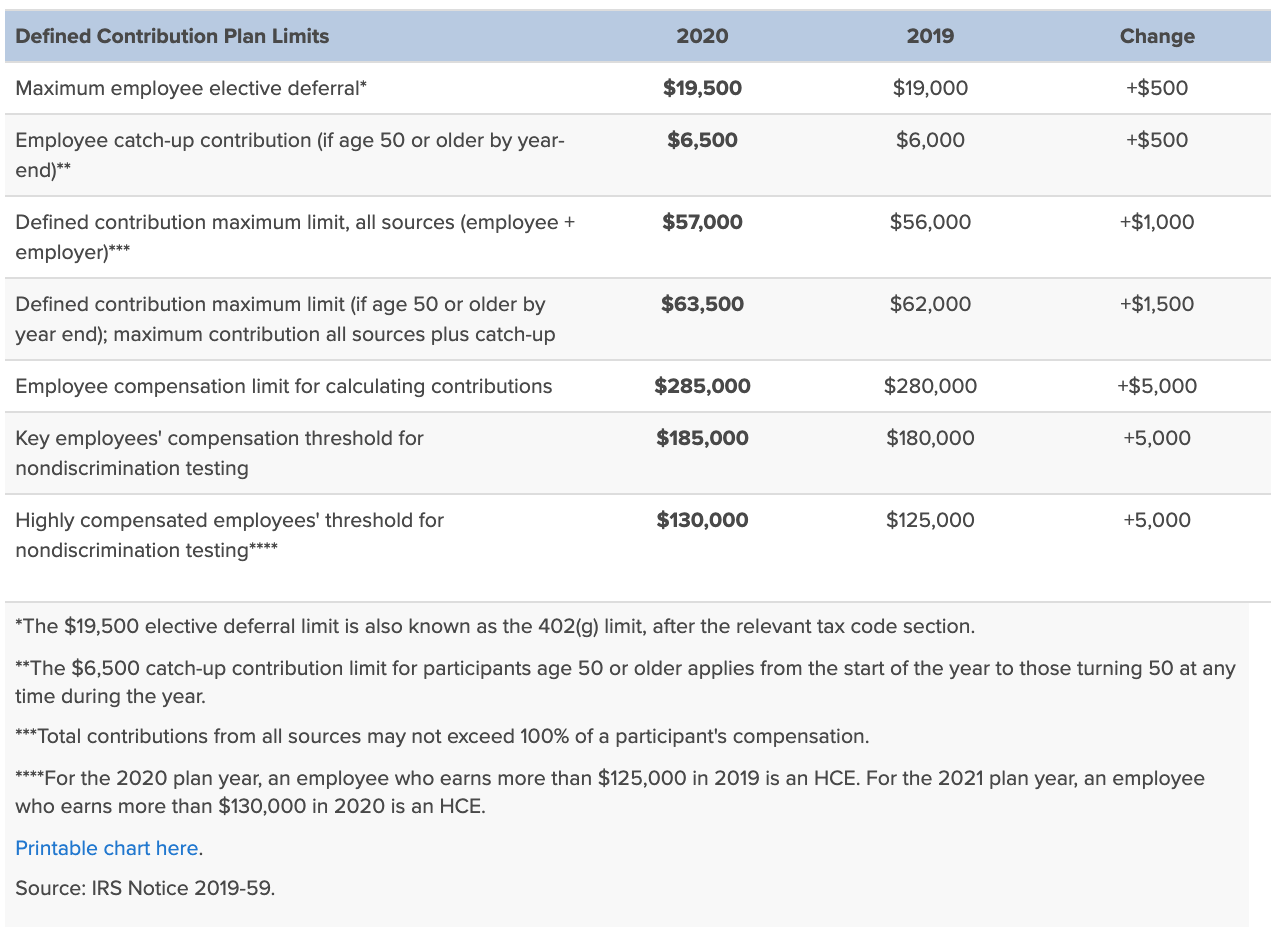

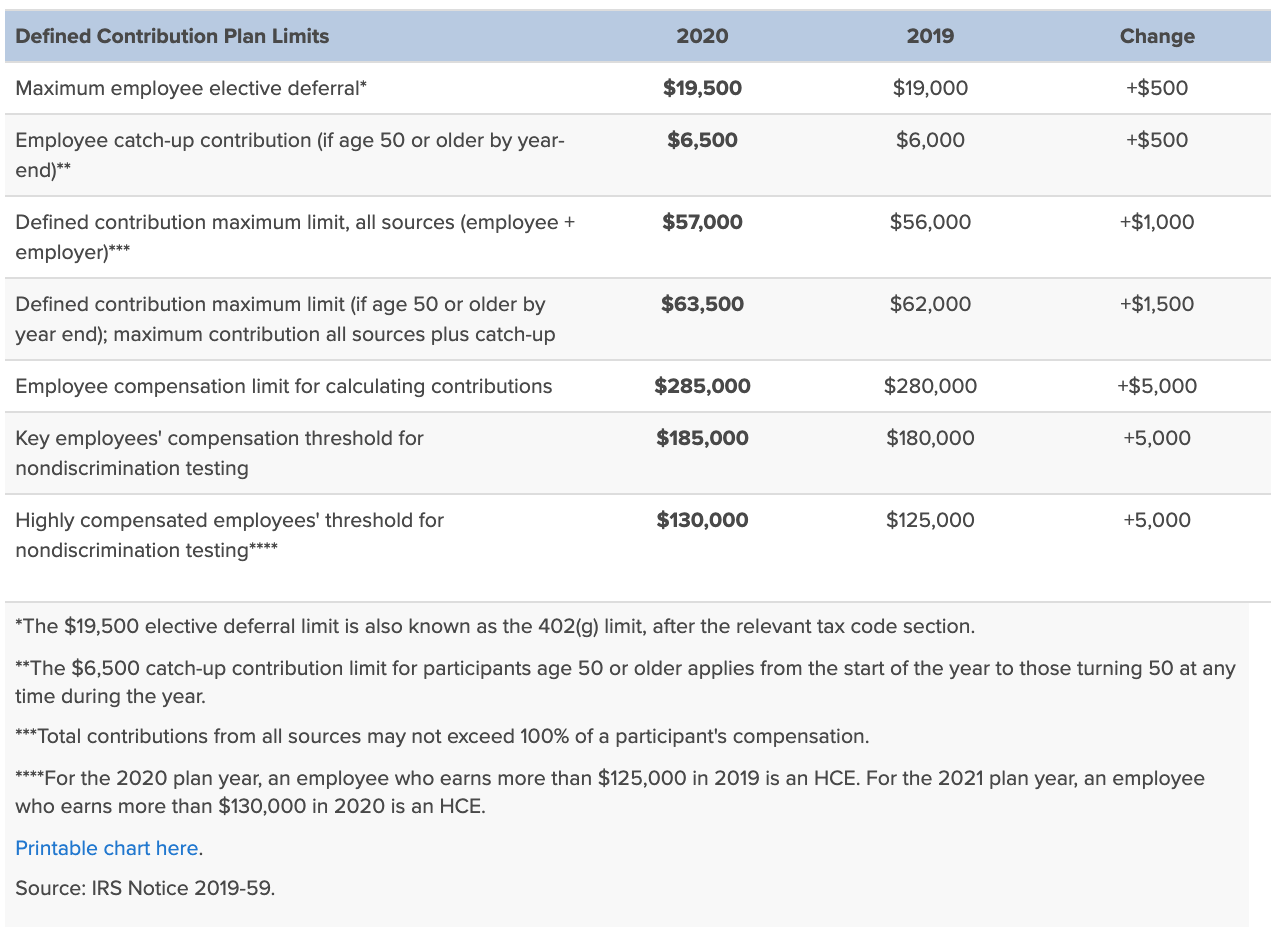

401(k) Contribution Limit Increases to $23,500

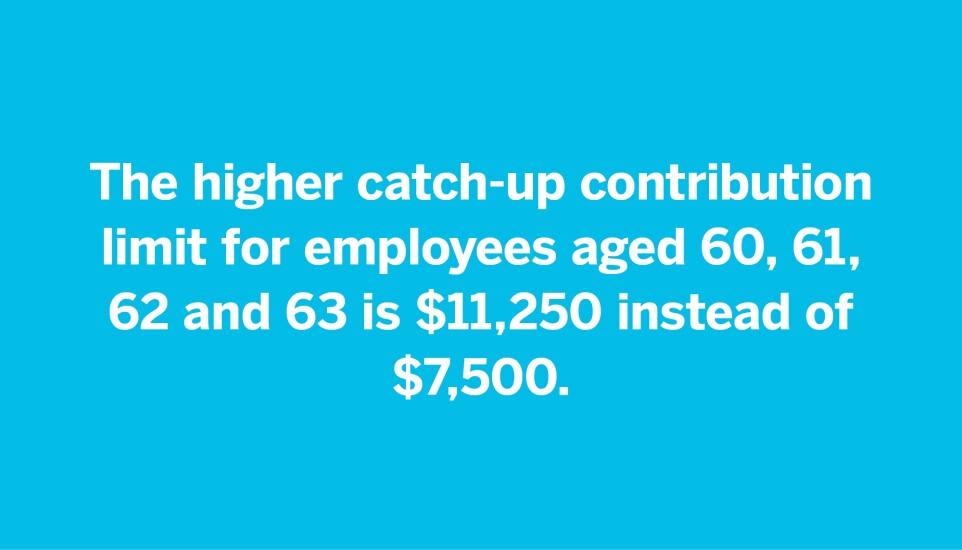

The $23,500 limit applies to traditional 401(k) plans, as well as Roth 401(k) plans. It's essential to note that this limit only applies to employee contributions, and does not include employer matching contributions. If you're 50 or older, you can also make catch-up contributions, which remain at $7,500 for 2025.

IRA Contribution Limit Remains at $7,000

_and_Roth_IRA_Contributions_Benefits.png?width=1920&name=Maxing_out_401(k)_and_Roth_IRA_Contributions_Benefits.png)

Despite the unchanged limit, IRAs remain a popular retirement savings option, especially for those who don't have access to an employer-sponsored plan. The flexibility of IRAs and the potential for tax-free growth make them an attractive choice for many individuals.

Maximizing Your Retirement Savings

With the increased 401(k) contribution limit and the unchanged IRA limit, it's essential to review your retirement savings strategy and make adjustments as needed. Consider the following tips to maximize your retirement savings: Contribute as much as possible to your 401(k) or IRA, especially if your employer offers matching contributions. Take advantage of catch-up contributions if you're 50 or older. Review your income and adjust your contributions accordingly to maximize tax benefits. Consider consulting a financial advisor to create a personalized retirement savings plan.By staying informed about changes to retirement savings plans and making the most of the increased contribution limits, you can boost your retirement savings and secure a more comfortable financial future.

The increase in the 401(k) contribution limit to $23,500 for 2025 provides an excellent opportunity for individuals to save more for their retirement. While the IRA contribution limit remains unchanged at $7,000, it's still essential to review your retirement savings strategy and make adjustments as needed. By maximizing your contributions and taking advantage of tax benefits, you can create a more secure financial future and enjoy a comfortable retirement. Keyword density: 401(k): 7 instances IRA: 6 instances Retirement savings: 5 instances Contribution limit: 4 instances 2025: 3 instances Meta description: "Stay informed about changes to retirement savings plans. The 401(k) contribution limit increases to $23,500 for 2025, while the IRA limit remains at $7,000. Learn how to maximize your retirement savings and secure a comfortable financial future."